As President Joe Biden and Speaker Kevin McCarthy are set to meet again on Monday to continue negotiations about raising the debt ceiling, time is running out to reach a deal that would avert a historic and most likely catastrophic default on the nation’s debt. Treasury Secretary Janet Yellen has repeatedly warned that the U.S. could run out of money to pay its bills on June 1, a feeling that many Americans can likely relate to.

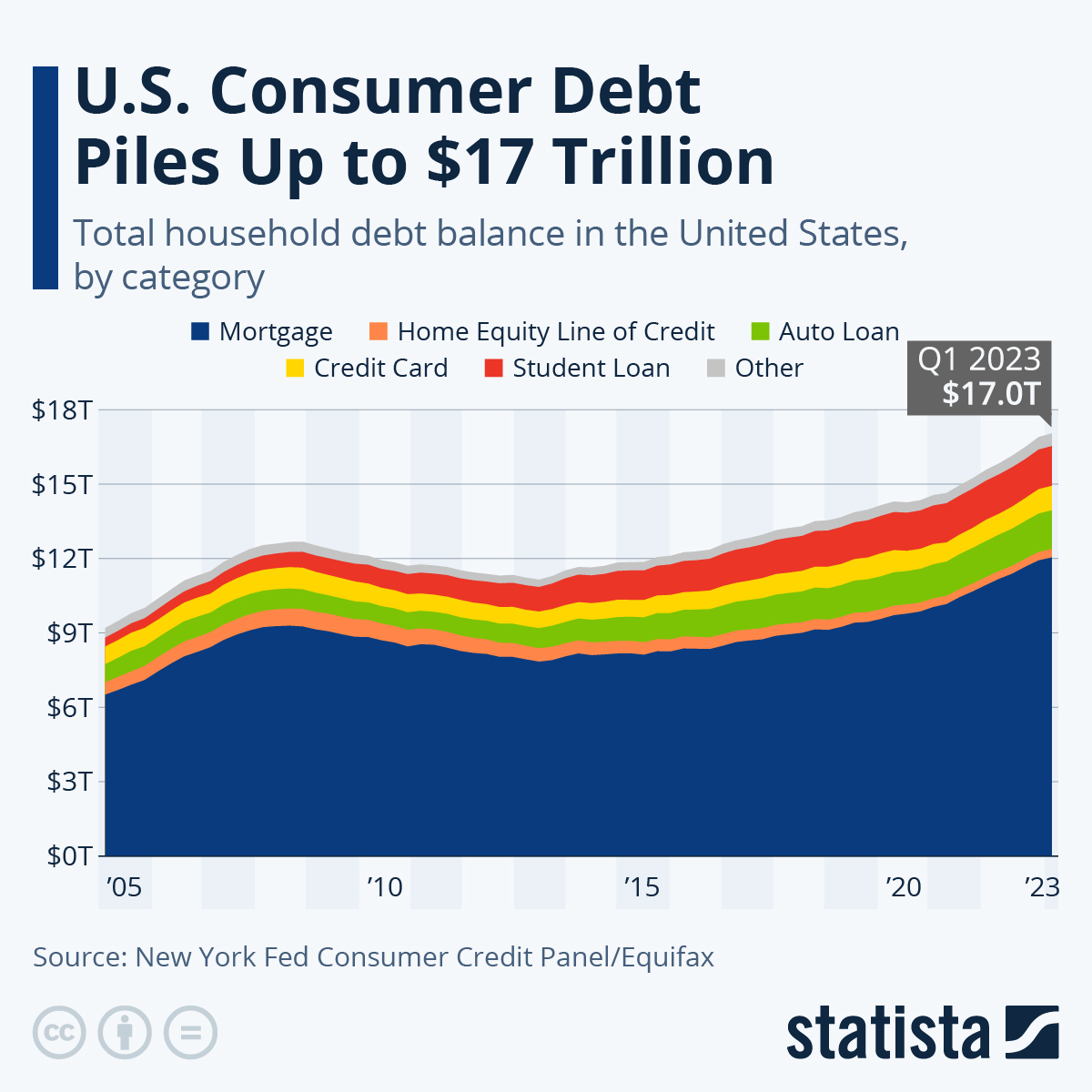

In fact, U.S. consumers are sitting on a historically high pile of debt themselves, as the following chart illustrates. According to the New York Fed’s Quarterly Report on Household Debt and Credit, total household debt climbed to $17.05 trillion in the first quarter of 2023, an increase of $2.9 trillion since Q4 2019, shortly before the pandemic hit. Unlike their government, most Americans currently have no problem servicing their debt on time, though, with delinquency rates near record lows despite a small uptick in the latest quarter. Looking at total consumer debt, 97.4 percent of the total balance was current or non-delinquent (i.e. all payments made on time or less than 30 days late) in Q1 2023, up from 95.3 in Q4 2019 and from less than 90 percent in the midst of the financial crisis.

The faster-than-usual increase in consumer debt over the past three years was mainly driven by a record volume of mortgage originations, as many households took advantage of historically low rates to refinance their mortgage and even take out some cash in the process. According to the New York Fed, 14 million mortgages were refinanced during the pandemic refinancing boom, during which home owners extracted $430 billion through cash-out refinances. As a result, mortgages accounted for 86 percent of the increase in total consumer debt since Q4 2019, followed by credit card debt and student loans, which accounted for 8 and 3 percent of the increase, respectively.

https://www.statista.com/chart/19955/household-debt-balance-in-the-united-states