This editorial ran in today’s Moscow-Pullman Daily News. Politicians will do nothing until it’s too late.

This editorial ran in today’s Moscow-Pullman Daily News. Politicians will do nothing until it’s too late.

According to the CBO, Social Security and Medicare will be insolvent in ten years. Millions of Americans face losing their monthly checks, and politicians aren’t doing anything about it.

Social Security was founded in the 1930s as a universal retirement program. Medicare was founded in the 1960s as a universal health insurance program for seniors. Both are funded by payroll taxes totaling 15.3% of an employee’s income.

Many think the employer and employee each pay half of the payroll taxes for Social Security and Medicare, but such is not the case. The employer deducts half before the paycheck even reaches the employee, making it seem like a shared cost. Though it may not appear as a separate line on your paystub, that “employer contribution” is part of the employee’s total compensation, so the employee effectively pays the whole amount.

Since American workers have paid into these programs over the course of their lives, they are collectively referred to as “entitlement programs.” However, if you look at your Social Security statement, you will not see the word “entitlement” used, only “tax.”

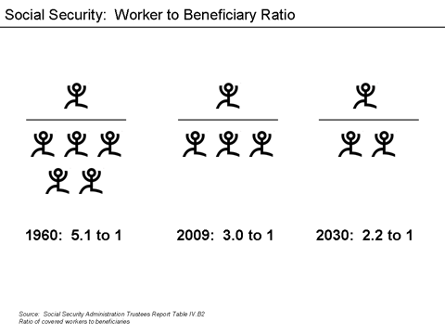

As the population ages and the number of retirees grows relative to the number of workers, this entitlement Ponzi becomes unsustainable. Because of the collapsing fertility rate, there are simply not enough Gen-X, Millennials, and Gen-Z to make up for the loss of Boomers in the workforce. And government Covid policies accelerated Baby Boomers exiting the workforce, moving up the insolvency timeline.

According to the Social Security Administration, by 2030 it will take 2.2 workers to support one entitlement beneficiary. And by 2035 that will be down to two to one.

Retirees: find a couple of young folks slaving away at their jobs and give them a hearty thank-you. They probably had nothing better to spend their money on anyway.

The CBO currently estimates a $23 trillion liability for Social Security and $36 trillion liability for Medicare. Those future, unfunded liabilities are off-the-books because, as I mentioned, the government considers these entitlement programs as a tax and not an entitlement.

The four largest budget items in the federal government are:

- Medicare/Medicaid: $1,611 billion

- Social Security: $1,314 billion

- Defense: $793 billion

- Interest on Debt: $672 billion

When the current recession hits hard, expect the deficit to skyrocket. Social spending will increase while tax and entitlement revenues drop, causing the deficit to balloon even further. This exacerbates the already grim outlook for Social Security and Medicare, which are on track for insolvency by 2033 and 2031, respectively. Depleted reserves leave us with bleak options: either slash Social Security benefits by 23%, hike taxes significantly, or pile on more national debt. Meanwhile, Medicare is staring down an $80 billion annual deficit that’s set to grow.

Imagine setting up a child’s trust fund, pledging every dollar for their education or a house. But over time, whenever you find yourself short on cash—be it for home repairs, vacations, day-to-day expenses, or a trip to Vegas—you dip into that fund. You justify it by saying, ‘I’ll pay it back eventually.’ But years go by, and not only do you not replenish the fund, but you also continue to raid it for your immediate wants. When the day comes for your child to go to college or buy a home, the fund is nearly empty, putting their future at risk.

This is essentially what Congress has been doing to the Social Security Trust Fund for years. While these funds were earmarked for the retirement of millions of Americans, Congress has borrowed from the coffers to pay for other programs, promising to “pay it back” in the future. But as the future arrives, the fund is depleted, and the “child”—in this case, the American retiree—is the one who suffers.

Our country’s most significant entitlement programs are ticking time bombs set to explode within a decade. The numbers are nightmarish. We’ve allowed politicians to fiddle while Rome—or in this case, our financial security—burns. Unless significant changes occur, the fallout will be monumental enough to impact every American, young or old. But if history is any indication, politicians will put off fixing the problem, and will raise the debt and taxes on the middle class.