What happened to all that money that was taken from my paychecks for the last 40 years for Social Security, Medicare/Medicaid?

Oh, that’s right; the politicians used it to pay for other things.

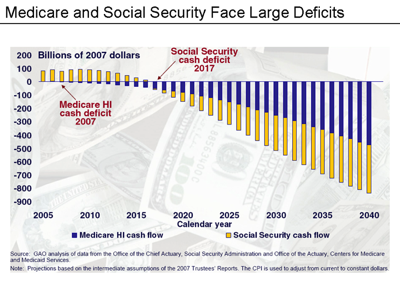

The federal government’s two largest entitlement programs will both run out of money within 20 years, according to annual reports released this week.

The reports indicate that Social Security will deplete its financial reserves by 2035, while the Medicare trust fund will become insolvent by 2029.

Collectively, the two programs account for more than 40 percent of total federal spending.

In 2016, Medicare provided benefits to 56.8 million Americans, including 9 million disabled individuals and 47.8 million people 65 and older.

According to its annual report, the program paid out $679 billion in benefits last year and collected $710 billion in income, primarily through payroll taxes and monthly premiums for Medicare Part B and D. It also has $295 billion in assets.

Given projected utilization growth and increases in health care costs, total costs are expected to exceed income beginning in 2022. The $295 billion trust account can make up the difference for a few years, but the annual report indicates those assets will be depleted by 2029.

Social Security has an even larger footprint. It provided benefits to 61 million Americans last year, including 11 million disabled individuals and another 50 million retirees and dependents.

According to its annual report, the program collected $957 billion in income in 2016, including $88 billion in interest and $869 billion from a 12.4 percent payroll tax. It paid out $922 billion in benefits, and has another $2.85 trillion in trust.

As with Medicare, Social Security income is projected to drop below annual costs beginning in 2022, after which it will begin dipping into reserves. The Disability Insurance assets are expected to run out by 2028, while the Old Age and Survivors Insurance retiree assets are projected to last until 2035.

The report indicates that Social Security faces a $12.5 trillion unfunded liability over the next 75 years, reflecting the gap between benefits costs for current and future retirees and income from payroll taxes.

In order for the combined disability and retiree trusts to remain solvent throughout that 75-year period, the agency notes, an “immediate and permanent” payroll tax increase of 2.76 percentage points – to 15.16 percent – would be needed, or benefits for all current and future retirees would need to be cut by 17 percent.

If Congress fails to address the problem until the trust assets run out, the across-the-board cut would increase to 23 percent.

Maya MacGuineas, president of the Committee for a Responsible Federal Budget, said the two annual reports “show that lawmakers can no longer afford to keep their heads in the sand.”

“Social Security insolvency is no longer a problem only for future generations,” she noted in a news release. “Social Security and Medicare are both on borrowed time, and each day that passes without action makes the problem worse and the choices more severe. … If Congress can’t begin action immediately to implement policies to set these programs on a path to solvency, then it’s time to turn the task over to a bipartisan commission.”