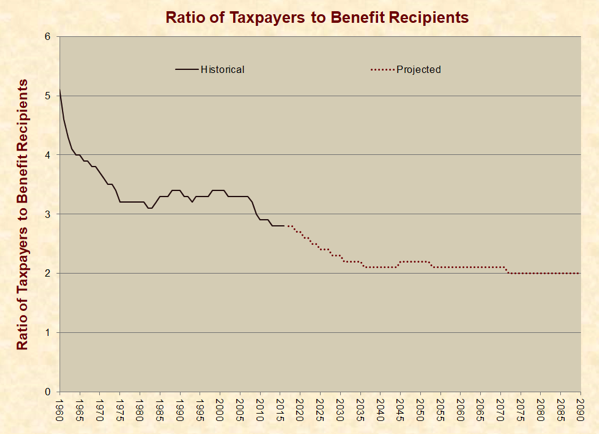

This chart says it all.

The Ponzi scheme is starting to collapse. We are already at the point where it takes 3 taxpayers to cover 1 Social Security recipient.

By 2035 (17 years) it will hover near 2 taxpayers for every 1 recipient.

It’s like the elderly walking down the street and holding up the first two people that pass by, taking their income.

More:

Three major factors contributing to the falling ratio of taxpayers to benefit recipients are:

- increases in life expectancy without comparable increases in the retirement age. Since Social Security began paying benefits in 1940, the average time spent collecting old-age benefits has increased by 45% for males and 47% for females.

- the higher birth rate of the baby boom generation compared to other generations. In two decades from the time that the first wave of baby boomers turned 65 years old in 2011, the number of people eligible for old-age benefits will increase by about 65%, while the number of people paying Social Security taxes will increase by about 18%.

- the rising number of people receiving disability benefits. Between 1965 and 2016, the U.S. population grew by 61%, while the number of people receiving disability benefits increased by 510%.

Social Security Has Been Boosted, Not Looted

The newly released Social Security Trustees Report describes serious fiscal issues with the program and stresses that it should be reformed soon, or the situation will become much worse. However, public support for reform is impeded by a common fiction that inflames debate and distracts from the roots of the problem.