What’s happened during the last 9 years?

Oh, yea, that’s right.

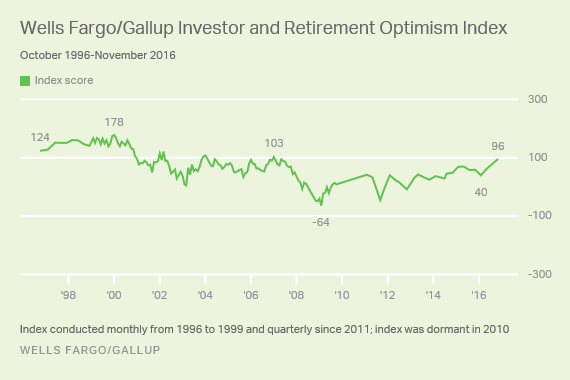

After reaching a nine-year high in the third quarter, the Wells Fargo/Gallup Investor and Retirement Optimism Index rose further in the fourth quarter to its highest point since January 2007. The index now stands at +96, up from +79 last quarter and from +40 in the first quarter after stock market volatility rattled investor confidence.

The fourth-quarter reading is based on telephone interviews conducted Nov. 16-20 with a nationally representative sample of 1,012 U.S. investors who report having $10,000 or more in stocks, bonds, mutual funds, or a self-directed IRA or 401(k).

Reflecting the results of the 2016 presidential election, investor confidence zoomed 155 points in the post-election poll among investors who identify as Republican, from an index score of 0 in the third quarter to +155 in the fourth. Conversely, Democrats’ confidence fell by nearly as much, from +174 to +25. At the same time, the index rose only slightly among those with $100,000 or more in investments, from +99 to +105, while it jumped from +55 to +87 among lower-asset investors.

The Wells Fargo/Gallup Investor and Retirement Optimism Index has been conducted quarterly since 2011. The Gallup Index of Investor Optimism, which provides the historical trend, was conducted monthly from October 1996 through October 2009. The index has a theoretical range of +400 to -400, but in practice has ranged from +178 at its highest point in January 2000 to -64 at its lowest in February 2009.

Via Gallup