Today’s OpEd is on the decline of the dollar on the world market, and the implications on America. This ran in the Moscow-Pullman Daily News.

The American dollar’s nearly century-long reign as the untouchable global kingpin is coming to an end. Five nations are sick of dancing to the tune of Western financial imperialists, and this emerging coalition is committed to abandoning the US dollar.

Back in April 2022 I warned about the fragility of the petrodollar system (The Declining Petrodollar), a nearly century-old structure that secures the U.S. dollar’s status as the world’s global reserve currency. This system allows the U.S. to maintain its massive debts — $102 trillion total debt (federal, state, local governments; interest; financial institutions plus businesses and households) and an additional $193 trillion in off-the-books liabilities (Medicare A, B, and D; Social Security; military and civilian benefits; federal debt held by the public; etc.) — by necessitating that oil transactions and most global trade be conducted in dollars.

However, BRICS — the fifteen-year alliance of Brazil, Russia, India, China, and South Africa — isn’t playing the game any longer. It’s crafting a dollar alternative.

China, the world’s largest oil consumer, already has dollarless trade agreements with several countries, including Russia and Saudi Arabia. India, the world’s third largest oil consumer, bypasses the dollar in oil deals with Russia and conducts trade in rupees with 18 nations. Brazil and China trade directly in their respective currencies, and Russia’s use of the yuan now surpasses that of the dollar. Even Iraq’s central bank has greenlit yuan transactions.

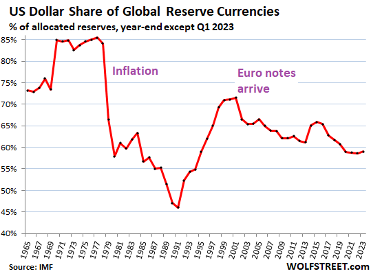

In the 1970’s, the U.S. dollar’s share of global reserve currencies was 85%. After the Euro notes arrived in 2002, that fell to 72%. Today it’s 58%.

Last week, Johannesburg became the stage for BRICS to throw down the gauntlet, signaling it’s no longer business as usual for the dollar. Six additional countries joined (BRICS-11 now includes Saudi Arabia, Argentina, UAE, Egypt, Iran, and Ethiopia), while another twenty nations are waiting to join.

Last week, Johannesburg became the stage for BRICS to throw down the gauntlet, signaling it’s no longer business as usual for the dollar. Six additional countries joined (BRICS-11 now includes Saudi Arabia, Argentina, UAE, Egypt, Iran, and Ethiopia), while another twenty nations are waiting to join.

BRICS-11 is challenging the world’s “largest economies,” the Group of Seven (G7): United States, Japan, Germany, United Kingdom, France, Italy, and Canada. “Largest economies” is a misnomer, however. According to the International Monetary Fund (IMF), as of Aug 2023 China is already #2, India #5, and Brazil #10.

BRICS-11 is nipping at G7’s heels, already generating a whopping 67% of G7’s economic output. BRICS-11 now controls 39% of global oil exports; 46% of proven reserves; and 48% of all oil produced globally.

Further, the Organization for Economic Cooperation and Development estimates that by 2030, the world’s ten largest economies will be:

- China

- USA

- India

- Japan

- Indonesia

- Germany

- Russia

- Brazil

- Turkey

- UK

The newspaper “India Narrative” calls BRICS “a new world order,” just not the New World Order cooked up in smoke-filled rooms by Western globalists. By 2030, BRICS’ GDP will be larger than the G7’s.

Oilrpice.com said that a “mutual skepticism” binds the BRICS countries which are spread across continents with distinctive economic models. “They question a world order seemingly skewed towards the interests of the US and its allies. An order they believe sets global norms that the West expects others to follow, without always adhering to them themselves.”

Expect retaliation from Western leaders keen on preventing BRICS from altering the global pecking order—perhaps even in the form of military confrontations with Russia and China. While China and Russia suggested a gold-based currency at the last BRICS assembly, India nixed the idea, cautious of provoking U.S. retaliation. Still, the U.S.’s grip is loosening. Falling demand for the dollar will rapidly devalue it, leading to escalating inflation and, in the worst-case scenario, a full-blown collapse.

As BRICS grows—expanding to 11 nations now, and to 20 then 40 in the next few years—they’re set to claim a louder voice in international institutions traditionally dominated by Western powers. This seismic shift will undoubtedly result in significant geopolitical realignments and power struggles.

The dollar’s plummet will hit average Americans hard, causing everything from surging consumer prices to more expensive overseas trips. Furthermore, those without substantial assets—like real estate or stocks—will watch their savings erode due to inflation.

As the dollar’s fall from grace looms, what remains “almighty” is our government’s willful ignorance, as they turn a blind eye to an impending free-market catastrophe.