Who in their right mind would charge anything at a 30% interest rate!

Who in their right mind would charge anything at a 30% interest rate!

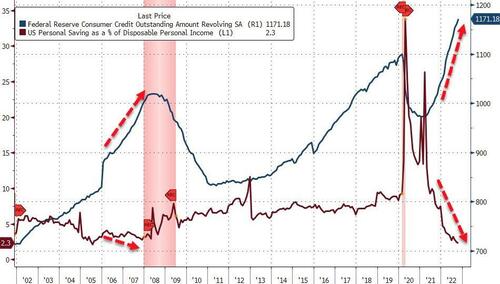

There has been a massive surge in credit card usage by US households, a troubling sign that could suggest that in lieu of disposable income, many consumers are forced to max out credit cards to survive the inflation storm.

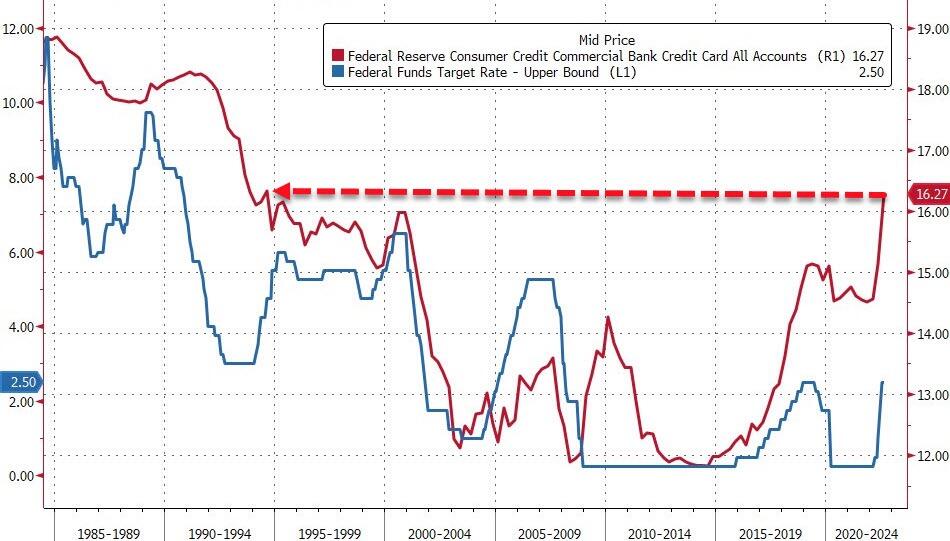

A major problem with inflation is that monthly balances keep rising as the cost of goods becomes more expensive, but the interest rates consumers pay on the debt are also rising because of the Federal Reserve’s most aggressive tightening spree in a generation to quell inflation.

As consumer balance sheets become more saturated with credit card debt, it will become harder to pay off as rates rise. According to the Federal Reserve Bank of New York, the total US household debt swelled by $351 billion in the third quarter to $16.5 trillion. Credit card balances jumped 15%, the fastest annual rate in two decades.

Households are taking on insurmountable credit card debts while rates are climbing — as well as personal savings is collapsing.