And notice that all of these cities were run into the ground by Democrats, where money grows on trees.

And notice that all of these cities were run into the ground by Democrats, where money grows on trees.

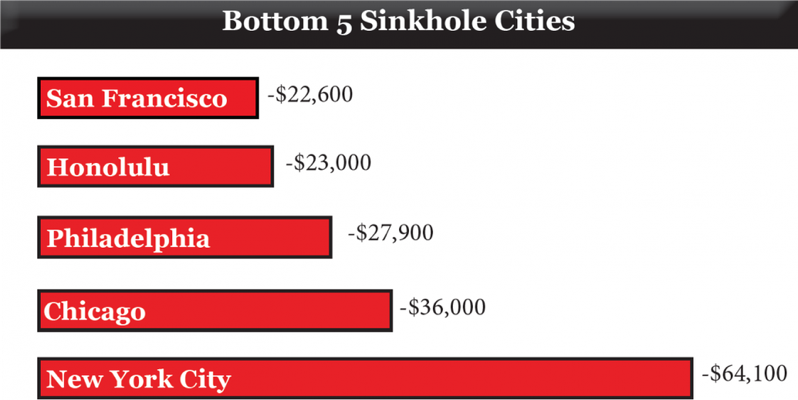

Sixty-three, out of America’s most populous seventy-five, cities do not have enough money to pay all of their bills. Chicago-based municipal finance watchdog, Truth in Accounting(TIA) revealed these stark news in its third annual,Financial State of the Cities. According toTIA,“This means that to balance the budget, elected officials have not included the true costs of the government in their budget calculations and have pushed costs onto future taxpayers.” TIA divides the amount of money needed to pay bills by the number of city taxpayers to come up with what it calls Taxpayer Burden™.

Based on TIA’s grading methodology, for the second year in a row, not a single one of the 75 cities received an ‘A’. TIA, however, was unable to rank and grade two of the most populous cities, Newark and Jersey City in New Jersey, because unfortunately, they do not issue annual financial reports that follow generally accepted accounting principles, GAAP.

A grade: Taxpayer Surplus greater than $10,000 (0 cities).

B grade: Taxpayer Surplus between $100 and $10,000 (12 cities).

C grade: Taxpayer Burden between $0 and $4,900 (24 cities).

D grade: Taxpayer Burden between $5,000 and $20,000 (31 cities).

F grade: Taxpayer Burden greater than $20,000 (8 cities).

The 75 most populous cities’ total unfunded debt is approximately $330 billion. Most of this debt comes from unfunded retiree benefit promises, such as retiree healthcare debt and pensions. Unfortunately, one of the ways the cities help make their budgets look balanced is by shortchanging public pension funds. Presently, pension debt accounts for $189.1 billion, and other post-employment benefits (OPEB), mainly retiree healthcare liabilities, is about $139.2 billion.

America’s Largest Cities Are Practically Broke

Municipal watchdog, Truth in Accounting’s third annual Financial State of the Cities, reveals that America’s largest cities do not have enough money to pay all of their bills. Irvine, CA and Charlotte, NC are in the best shape, while New York City and Chicago are in the weakest fiscal condition.